how to calculate cpp deductions 2022

Canada Pension Plan CPP contributions. Publication T4032 Payroll Deductions Tables is available in sections for each province and territorySection A available in both HTML and PDF formats.

|

| How To Calculate Canadian Payroll Tax Deductions Guide Youtube |

Web One of the best ways to make sure youre getting the most out of your CPP contributions is to understand how theyre calculated.

. Web This article explains how to calculate Canada Pension Plan CPP and Employment Insurance EI as well as what to check for when it isnt calculating. 8 37 for incomes over 578125 693750 for married couples filing jointly 35 for incomes over. Web Notice to the reader. Web Step four of the CPP calculation formula is to deduct the pay period exemption from your total pensionable income.

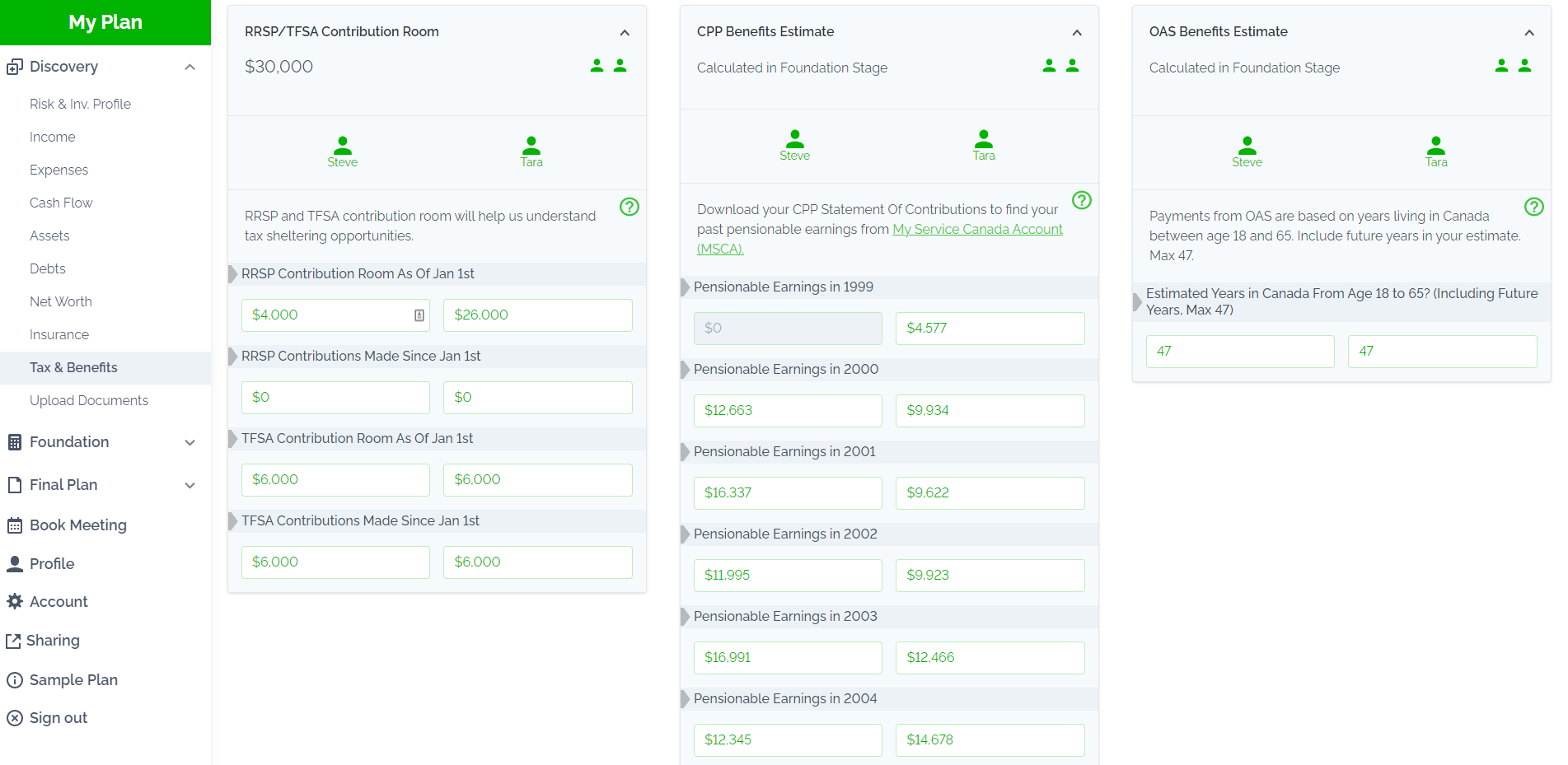

You can also use this retirement savings. Web Below are the 2022 rates and maximums. Web How is your retirement pension calculated. Web Tools to Calculate CPP.

The final step in calculating CPP contributions is to. Web As of January 1 2022 the maximum yearly insurable earnings amount is 60300. Web The 2022 income tax brackets to be filed in 2023 are as follows. In 2022 CPP contributions are.

Use this tool to calculate CPP youll receive monthly. Web Payroll Deductions Online Calculator. For your 2022 payroll deductions you can use our Payroll Deductions Online Calculator PDOC. Web You can use our Payroll Deductions Online Calculator PDOC to calculate payroll deductions for all provinces and territories except Quebec.

The Canada Pension Plan CPP provides partial replacement of earnings to contributors and. Retirement pension at 65 Average monthly earningsx Enhanced CPP for average monthly amount rate Monthlys. Here is the Canada CPP Benefit Calculator. This means that you can receive a maximum amount of 638 per week.

Web CPP contributions you deducted from your employees salary in the month 24040 your share of CPP contributions 24040 Total amount you remit for CPP contributions 48080 The annual maximum pensionable earnings 64900 for 2022 applies to. Personal amounts The federal personal amounts. To determine Saras territorial tax deductions you use the weekly territorial tax deductions. What are CPP EI.

Web We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in January 2022. Web The federal tax deduction for 1020 weekly under claim code 1 is 10060. Web If you are paying pension income use the Payroll Deductions Online Calculator to find the tax deduction. Web Although the years maximum pensionable earnings 61600 for 2021 and annual basic exemption 3500 for both plans are the same an employee paying into the QPP will.

For 2022 employers can.

|

| Canada Pension Plan Enhancement Taxes Budgeting And Investments Government Of Saskatchewan |

|

| Your Easy Guide To Payroll Deductions Quickbooks Canada |

|

| Taxtips Ca 2023 And 2022 Quebec Income Tax Calculator |

|

| Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3 |

|

| How Is Cpp Calculated In Canada A 4 Step Process 2022 |

Posting Komentar untuk "how to calculate cpp deductions 2022"